Discover the Patent Box

We help you manage your company’s intangible assets so that you can achieve tax savings of up to 60%.

Management of intangible assets: Patent Box

The Patent Box is a valuable tool for companies seeking to make the most of their intellectual property and obtain significant tax advantages.

By following a proper process and complying with legal requirements, companies can improve their competitiveness, stimulate innovation and optimise their financial resources. For more information on how to implement the Patent Box in your company, contact a2d innova, our experts in R&D&I financing will take care of the whole process.

What is the Patent Box?

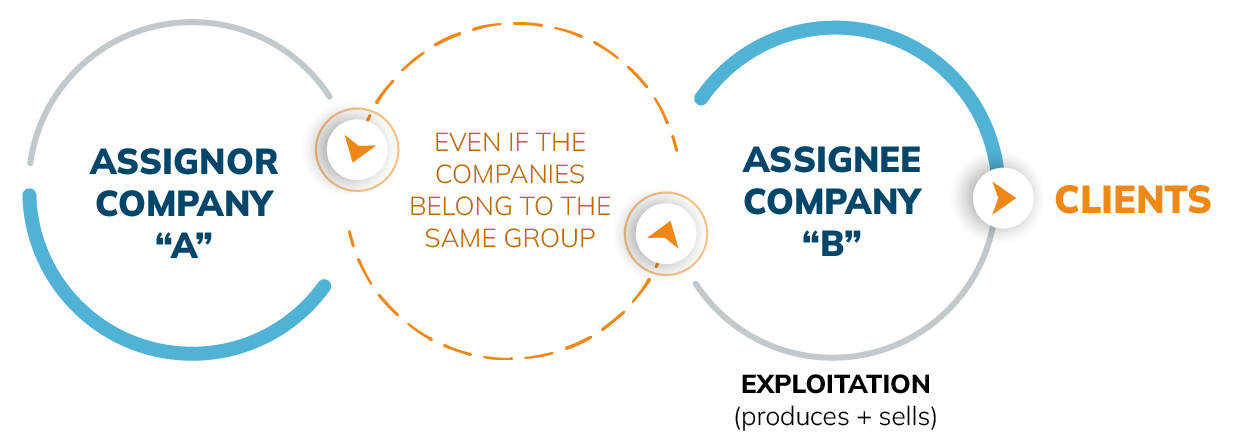

It consists of the transfer of knowledge created by one company to another, which may belong to the same group, so that the latter pays for the transfer of these intangible assets. 40% of the income from the transfer of intangible assets is included in the tax base. In addition, only 50% of the income derived from the transfer of the right to use or exploit patents, designs or models, plans, formulas or secret processes will be considered when calculating corporate tax.

Company “B” pays “A” for the transfer of the knowledge. The contract must clearly describe the accessory services.

Reduction of taxation

60% reduction on the income from the transfer of the right of use or exploitation.

The income eligible for reduction will not be the gross income obtained from the transfer of use, but the income net of depreciation, impairment and other expenses directly attributable to the transferred assets. If the asset does not appear on the balance sheet, 80% of the gross income shall be taken as income eligible for reduction.

The reduction of the income calculated in this way increases to 60%, meaning that only 40% of the income is included in the taxable base. Consequently, for the general corporate tax rate, this results in an effective tax rate of 12% on that income.

The amount of the 60% reduction will be weighted according to the expenses subcontracted with related third parties:

- Expenses incurred by the assignor directly related to the creation of the asset, including those from subcontracting with unrelated third parties, increased by 30%, provided that the numerator does not exceed the denominator.

- Expenses incurred by the assignor directly related to the creation of the asset, including those arising from subcontracting and, where applicable, from the acquisition of the asset.

Application of the Patent Box

- The application of the Patent Box is permitted in assignments made to entities that are part of the same tax consolidation group.

- Income, expenses or results relating to the Patent Box will be eliminated when determining the taxable income of the consolidated group.

- They will be included in the tax period in which they are deemed to have materialised with respect to third parties.

- The transactions must be subject to transfer pricing documentation, notwithstanding the general exception provided for entities in the same tax consolidation group.

Advantages

The Patent Box offers significant advantages for companies involved in R&D&I activities.

Reduction of Taxation

It allows for reduced taxation on income generated by intellectual assets, which reduces the company’s tax burden

Incentive for Innovation

Encourages innovation and investment in research and development by rewarding the protection of intellectual property.

Improved Competitiveness

Increases the company’s competitiveness by enabling effective management of intellectual property and asset monetization.

Financial Optimization

Contributes to financial optimization by taking full advantage of available tax benefits, thereby increasing revenue and profitability.

1

At a2d innova we identify your intellectual assets and classify them as patents and copyrights.

2

We take care of properly registering and protecting these assets, which involves following legal procedures to ensure their validity.

3

FAQ’s

What types of intangible assets can be included in the Patent Box?

It includes assets such as patents, duly registered advanced software, legally protected designs and models, utility models and supplementary protection certificates for medicines or phytosanitary products developed by your company. It is important to note that certain assets, such as trademarks, artistic or scientific works, image rights, industrial, commercial or scientific equipment, as well as secret plans, formulas or processes, are excluded from this scheme.

What research and development requirements must I meet in order for my company to benefit from the Patent Box?

To take advantage of the Patent Box, you must demonstrate that your company is conducting research and development activities related to the intangible assets you want to include. It is essential to document these activities and ensure that you comply with tax regulations.

Which R&D&I activities are eligible for this type of tax incentive?

Activities such as scientific research, experimental development, the creation of new products or processes, as well as the substantial improvement of existing ones, are often considered eligible for the Patent Box. It is important to document these processes and the results obtained in detail to support eligibility.

What are the legal mechanisms available to apply this tax benefit?

In order to provide legal certainty in the use of this tax incentive, the possibility of requesting from the Tax Administration a prior assessment agreement and a prior agreement on the classification and valuation of income from specific intangible assets before carrying out such operations is facilitated.